A data platform for ESG financial analysts

How we built a no-code data platform to automate ESG document workflows

As the maintainers of pandas-ai, our code simplifies the lives of thousands of data analysts, and many of them are ESG data analysts. We love to talk with our users to deeply understand their struggles and solve annoying problems. This blog post is exactly about that. It's about the journey that led us from simple conversations to a no-code data platform for ESG workflow automation. Grab a coffee and enjoy ESG document operations x10 faster ⚡

Table of Contents

- A day in the life of an ESG analyst

- The ESG analyst challenge: drowning in data

- Speed up ESG analysis: overview of our no-code data platform

- The ESG platform in detail, what shall we build next?

- Working with ESG: tell us more about your work day!

If you’re an ESG analyst, share your biggest challenges with us, so that we can continue to refine and enhance our solutions to better meet your needs.

A day in the life of an ESG analyst

Imagine yourself at your desk, a steaming cup of coffee in hand, as the first rays of sunlight filter through your office window. As an ESG analyst at a leading financial institution, you know that today, like every day, holds both challenges and opportunities. You're tasked with distilling vast oceans of data into clear, actionable insights that will shape investment decisions and corporate strategies.

But as you boot up your computer, a familiar sense of dread creeps in. Your inbox is overflowing wit new reports, your desktop cluttered with countless PDFs, and your browser tabs are a maze of corporate websites. How will you make sense of it all before the board meeting next week?

The ESG analyst challenge: drowning in data

This scene is all too familiar for ESG analysts worldwide. Take, for instance, a manager in an Italian bank who recently reached out to us. Their ESG team was grappling with over 4,000 documents – a mix of PDFs, websites, and spreadsheets. The kicker? Relevant ESG information was often buried deep within these files, sometimes comprising less than 5% of the total content.

The challenges were clear:

- Wading through oceans of data to find ESG gems

- Deciphering complex reports on emissions and social impact

- Extracting and standardizing key metrics from diverse sources

- Crafting compliant, comprehensive reports under tight deadlines

Sound familiar? We thought so. And this is where our story takes a turn. Imagine a world where your morning coffee is for enjoyment, not just fuel for the data mining ahead.

Speed up your ESG analysis: platform overview

Building on the success of pandas-ai, which is trusted by thousands of data analysts worldwide for EDA, we've developed a specialized platform designed to tackle the four main challenges faced by ESG analysts:

- Handling diverse ESG data sources

- Navigating and analyzing content efficiently

- Extracting specific ESG metrics

- Drafting compliant ESG reports

The end solution is a no-code data platform where you:

- Drag and drop all your ESG sources, letting the AI dealing with text extraction from messy files

- Quickly explore your ESG sources with a chat interface

- Define ESG extractions and topic-specific summaries in minutes, downloading them as familiar spreadsheets

- Draft TCFD and GRI-compliant reports at incredible speed

If you’re an ESG analyst, share your biggest challenges with us so we can continue to refine and enhance our solutions to better meet your needs

The ESG platform in detail, what shall we build next?

Remember the ESG team at that Italian bank, grappling with 4,000 documents? Let's revisit how our platform transforms their ESG data challenge into a simpler and smoother process

Handling diverse ESG data sources

Picture this: the ESG team drags and drops those 4,000 mixed files into our platform. In a few minutes, the AI springs to life, extracting key insights from PDFs, parsing websites, and standardizing spreadsheets. No matter how messy or diverse the data, our system handles it all. What was once a daunting pile of disparate data sources becomes a unified, analysis-ready dataset. No more manual sorting or data cleaning - just pure, ready-to-analyze ESG information.

Navigating and analyzing content efficiently

Now, the team sits before their screens, ready to dive in. Our chat-based exploratory data analysis (EDA) tool becomes their new best friend. They simply type, "What are the top environmental concerns in our lending portfolio?" The conversational interface processes the request, sifting through the thousands of documents in seconds. Key insights bubble to the surface, providing a clear picture of their portfolio's environmental landscape. It's like having a tireless research assistant, available 24/7 for every team member.

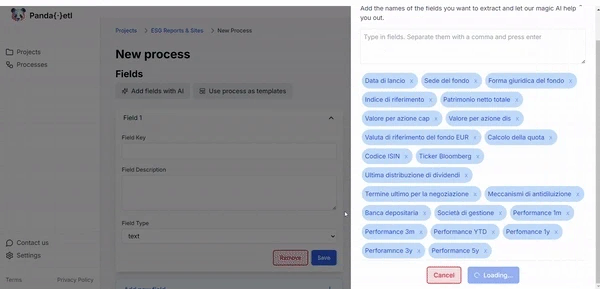

Extracting specific ESG metrics

Remember how less than 5% of those 4,000 documents contained relevant ESG data? Our platform shines here. The team opens up our customizable fields interface, which looks like a familiar spreadsheet. They input column names and descriptions for the metrics they need:

| Column Name | Description |

|---|---|

| Financed_Emissions | Total financed emissions in tons CO2e |

| SBT_Coverage | Percentage of loan portfolio to companies with science-based targets |

| Gender_Diversity | Percentage of women in leadership roles in financed companies |

| Green_Revenue | Percentage of revenue from environmentally beneficial products/services |

| Climate_Risk_Exposure | Estimated financial exposure to physical climate risks (in €) |

Our advanced NLP router takes these descriptions and starts processing, precisely locating these needles in the haystack of documents. It scans through PDFs, parses websites, and combs through spreadsheets, extracting the relevant data for each metric.

Within minutes, a clean spreadsheet appears on their screens. The columns are perfectly aligned with their custom fields, filled with the exact metrics they specified. What once took days of manual searching and data entry now happens in the blink of an eye. The ESG team can immediately start analyzing trends, identifying risks, and uncovering opportunities in their portfolio.

As they scroll through the neatly organized data, the team realizes they've just reclaimed countless hours that would have been spent on data gathering. Now, they can focus on what they do best: providing insightful analysis and strategic recommendations to guide the bank's sustainable finance initiatives.

Drafting compliant ESG reports

Here's where the magic really happens. The problem with extraction is that sometimes it's more difficult than one thinks to identify precise data, and this could be a problem while drafting. For this reason, we have built a topic-based extractive summary model that gets the more relevant sentences for you. These concise extractive summaries, alongside the extractions, can then be used for the compliant reports.

The ESG team needs a TCFD-compliant report on climate risks in their loan book. They input this requirement and specify key topics to focus on, eliminating noise and zeroing in on what matters. The system swings into action, not just summarizing but intelligently extracting only the most relevant information from those thousands of documents. It pulls key sentences, crafts concise summaries, and even generates a draft report that ticks all the compliance boxes. Our language model ensures the report is not just accurate, but also compliant with legal standards. What's more, it provides clear references back to the source documents, ensuring transparency and traceability.

As the ESG team gathers for their morning espresso, they marvel at the transformation. Those 4,000 intimidating documents? Tamed. The looming board meeting deadline? No longer a threat. They now have time to do what they do best - providing nuanced, expert analysis that drives strategic decision-making for the bank's sustainable finance initiatives.

What should we focus next?

Working with ESG: tell us more about your work day!

As the team behind pandas-ai, we've always believed in the power of community-driven development. Just as thousands of data analysts have helped shape pandas-ai into the powerful EDA tool it is today, we're inviting you – the ESG experts – to help us refine this specialized platform.

What unique challenges do you face in your ESG analysis work? How can we further streamline your workflow? Your insights will shape the future of ESG analysis tools, a future where ESG analysts spend less time wrestling with data and more time driving sustainable financial decisions.